As artificial intelligence (AI) transforms the tech landscape, Nvidia (NASDAQ:NVDA) has long dominated with its powerful GPUs, driving many of today’s leading AI applications. However, Broadcom Inc. (NASDAQ:AVGO), known for networking and connectivity solutions, is staking a claim in the AI chip market. With recent reports of a major partnership with OpenAI, Broadcom is gaining momentum in the AI race, potentially challenging Nvidia’s leadership.

Broadcom’s Expanding Role in AI and Cloud Markets

Based in Palo Alto, Broadcom Inc. is a global tech powerhouse, covering sectors from cloud and data centers to wireless and cybersecurity. With a market cap of approximately $787.2 billion, Broadcom’s stock has surged 92% over the past year, outpacing the S&P 500 Index’s ($SPX) 31.1% gain. This year alone, AVGO stock is up 51%, easily beating the S&P 500’s 19.8% year-to-date increase.

As the demand for AI technology skyrockets, Broadcom’s semiconductor expertise is in high demand, making it a strong contender in AI chip production. By aligning with tech leaders like Microsoft-backed OpenAI, Broadcom is securing its role as a key player in the evolving AI industry.

Key Details of Broadcom’s AI Partnership with OpenAI

Broadcom’s recent partnership with OpenAI could signal a significant shift in the AI landscape. Rather than developing its own chip production facilities, OpenAI has chosen Broadcom and Taiwan Semiconductor Manufacturing Company (NYSE:TSM) to develop custom chips tailored for AI inference. This collaboration, focused on in-house AI server chips, highlights Broadcom’s competitive positioning as a provider of critical AI infrastructure.

This partnership aims to address OpenAI’s unique AI demands, ensuring scalable, efficient performance for its growing applications. While OpenAI currently relies on Nvidia and Advanced Micro Devices (NASDAQ:AMD) chips, its alliance with Broadcom suggests a pivot towards more customized, cost-effective solutions as AI applications and data demands surge.

Broadcom’s Financial Highlights: Impressive Earnings Amid AI Growth

Broadcom’s recent Q3 earnings showcased robust financial health, with revenue reaching $13.1 billion, a 47.3% year-over-year increase. Adjusted earnings per share rose 19.1%, beating analysts’ expectations. However, conservative guidance for Q4 tempered investor enthusiasm, causing AVGO shares to dip post-earnings.

In Q3, Broadcom’s semiconductor solutions drove over half of its revenue, with the segment posting a revenue of $7.3 billion. The infrastructure software segment also surged, with revenue soaring to $5.8 billion—up 200% from last year. Free cash flow reached $5.3 billion, underscoring Broadcom’s ability to generate strong returns amid strategic investments.

CEO Hock Tan highlighted the growth in AI semiconductor solutions, with projected AI revenue expected to hit $12 billion for fiscal year 2024. Broadcom’s expanding investments in Ethernet networking and AI accelerators for data centers place it in a favorable position as AI adoption continues to grow.

Will Broadcom’s Partnership with OpenAI Challenge Nvidia?

Broadcom’s growing prominence in the AI chip industry raises questions about Nvidia’s long-standing dominance. Although Nvidia GPUs currently underpin most AI models, Broadcom’s alliance with OpenAI hints at an alternative path. Microsoft-backed OpenAI is reportedly moving away from costly reliance on external suppliers, aiming to establish more control over its AI technology stack through this collaboration.

With production slated for 2026, the Broadcom-OpenAI partnership could spark a shift in AI infrastructure. Broadcom’s expertise in high-speed connectivity and custom silicon design positions it well to address OpenAI’s specific needs, making it a potential alternative to Nvidia in key AI applications. For tech giants looking to diversify their suppliers and control costs, Broadcom’s approach offers a compelling option.

Broadcom Stock’s Investment Appeal

Broadcom’s financial strength and shareholder-friendly policies further enhance its appeal. With 13 years of consecutive dividend increases and a 1.25% dividend yield, Broadcom demonstrates a strong commitment to returning capital to investors. This September, Broadcom raised its quarterly dividend to $0.53 per share, yielding an annualized dividend of $2.12.

Analyst sentiment remains highly positive for Broadcom, with a consensus rating of “Strong Buy.” Among the 33 analysts covering the stock, 30 recommend a “Strong Buy,” while three suggest holding. The average price target for AVGO stock stands at $194.07, with a high target of $240, representing a potential 39% upside from current levels.

Conclusion: Is Broadcom Stock a Buy?

Broadcom’s strategic positioning in AI chips, combined with its strong financial performance and investor-friendly policies, makes it an attractive option for long-term investors. The partnership with OpenAI could mark a turning point in Broadcom’s role in AI, possibly creating new revenue streams and enhancing its influence in the tech industry.

While Nvidia maintains its leadership, Broadcom’s alliance with OpenAI indicates a shift in the competitive landscape. Investors may find Broadcom stock appealing as the company continues to gain ground in AI technology and expand its role in this fast-growing sector.

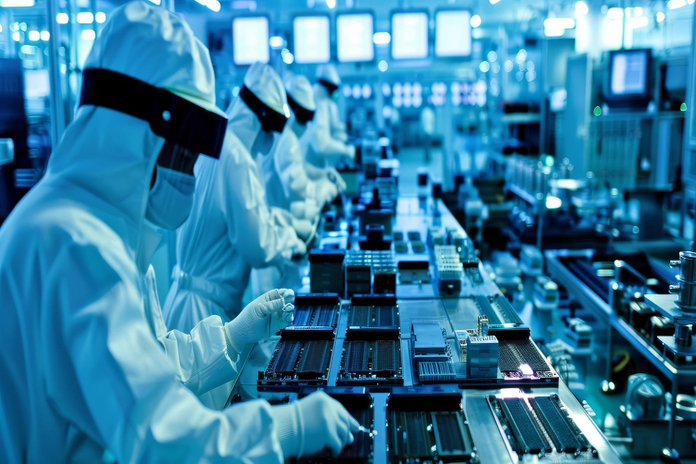

Featured Image: Freepik